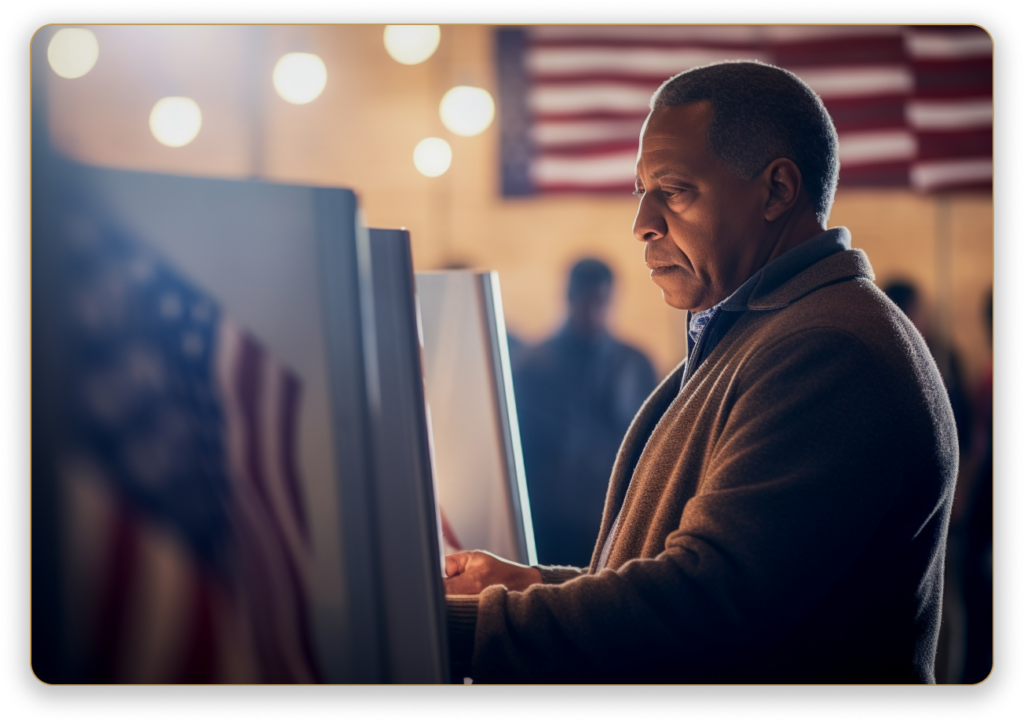

How Do Elections Impact Your Wealth?

Another election cycle has begun, and you may feel a looming anxiety about how your wealth and investment portfolio will be affected. Recent surveys show how heavily the 2024 election outcome is weighing on investors. A retirement study by Nationwide showed that 45% of respondents believe it will significantly sway their portfolios—more so than financial markets.1 This bipartisan concern spans 68% of Republican and 57% of Democratic investors surveyed. To that end, 33% of pre-retirees have already started to manage their investments more conservatively due to election uncertainty.2 Each time an election cycle revs up, people start to get nervous about their finances. In 2016, for example, 47% of investors with at least $1 million in assets3 considered reducing their market exposure around the…