8 Types of Trusts for Owners of High-Net-Worth Estates

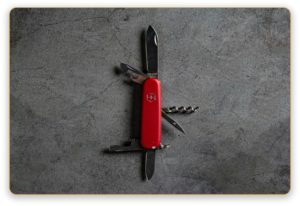

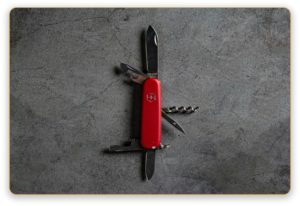

Think of trusts as the Swiss Army knife of financial and estate planning. With their adaptability and wide range of structures, trusts can cater to…

Adviser Investments and Polaris Wealth Advisory Group are now RWA Wealth Partners.

Attaining confidence in your retirement plan can be an elusive pursuit, even once you achieve financial success. A study1 found that 58% of high-net-worth individuals…

Please join us for a special presentation and learn strategies to help protect more of your wealth from the IRS. Hear our advice on how to maintain focus on your financial goals and not the upcoming elections.

Think of trusts as the Swiss Army knife of financial and estate planning. With their adaptability and wide range of structures, trusts can cater to a variety of financial needs. Whether you want to avoid probate, reduce your tax liabilities, guard your assets from potential claims, set guardrails around large monetary gifts, or facilitate the efficient transfer of wealth to future generations, trusts are often the most attractive solution. Despite their many advantages, trusts rarely receive the credit or attention they deserve in financial planning. According to a recent survey from Caring.com,1 over half of the wealthiest Americans have implemented no form of estate plan—no will, trust or advance directive. A staggering 54% attribute their inaction to procrastination. However, delaying these decisions can…

Think of trusts as the Swiss Army knife of financial and estate planning. With their adaptability and wide range of structures, trusts can cater to…

Are you hearing more about alternative investments? Alternatives include assets like private equity, private credit, hedge funds, real estate, art and luxury goods. The global…

Take a hard look at your estate plan. Does it show considerable tax exposure? Given the substantial increase in estate tax exemptions—rising to nearly $26…

Many prestigious families throughout history lost their fortunes within just a few generations. Consider the Vanderbilts, whose fortune originated in the railroad industry. In the…

Your wealth has the potential to change lives and communities for the better through charitable giving. With a thoughtful donation strategy, you have the potential…

Attaining confidence in your retirement plan can be an elusive pursuit, even once you achieve financial success. A study1 found that 58% of high-net-worth individuals…

Less than 9% of Americans1 become millionaires, and even fewer can make that money last. Economic volatility has historically triggered “richcessions,” or periods when high-net-worth…

Your wealth requires a sophisticated tax reduction strategy that addresses the diversity and magnitude of your assets. But unfortunately, it’s all too easy to overlook…

It’s One of the Smartest Tax Moves You Can Make. Substantial changes to the tax code are on the horizon, meaning you should review your…

It’s One of the Smartest Tax Moves You Can Make. The Roth IRA may be the best retirement savings vehicle available to the American investor today….

Let’s begin.

Required fields